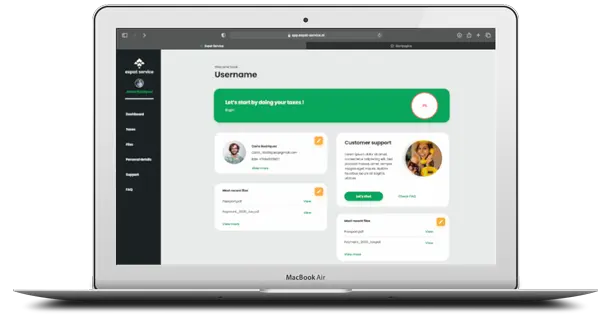

Expat Service helps expats with an online tax filing service for their income tax return. Efficient, simple and affordable tax filing whenever and wherever you are in the world. That’s why Expat Service is the intelligent choice for every expat.

Use our online tax filing service

Digitally file your personal tax return, all

forms (P, M, W and C)

Where and when you want, you can file your tax return. No more paperwork, all tax forms in English and completely digital.

Included in the price is that an expert checks your tax return for completeness. This can save you thousands of euros in tax.

Because you handle many things with our tax return software yourself, we can offer the best prices.

We apply only the highest possible security requirements, including those of the programs we work with. All operations are GDPR proof.

Trustindex verifies that the original source of the review is Google. After two tax applications, I’m certain I will also continue here. Very user-friendly and self explanatory tax application platform, straightforward process and even when something got in the way, assistance was offered immediately and issue resolved. Prices are also expat-friendly. Definitely recommend!Posted onTrustindex verifies that the original source of the review is Google. I booked a 30-minute advisory review with Ilyaas Hassan to discuss Box 3 taxes. Ilyaas explained the tax rules clearly to me in English using hypothetical examples, and furthermore answered all my questions thoroughly. No reason why he does not deserve a 5-star rating!Posted onTrustindex verifies that the original source of the review is Google. Expert, Reliable, and Supportive Tax Advice My situation was complicated with properties abroad and the ending of the 30% rule. They clarified all my doubts and showed deep knowledge in tax matters, which ultimately saved me a lot of money. I’m especially grateful that they worked over the weekend to ensure my tax returns were completed and filed before the deadline — I truly appreciate the extra effort. It’s reassuring to work with such a reliable, knowledgeable, and responsible team. Thank you again!Posted onTrustindex verifies that the original source of the review is Google. As a first time expat in the Netherlands, I had no idea what to do. These people made the whole process surprisingly easy. Roy was incredibly helpful as he explained everything clearly answered all of my questions and made sure nothing slipped through the cracks. It was such a relief to work with someone who really understands both Dutch and international tax rules and is super competent. Feels like they took a huge weight off my shoulders :)Posted onTrustindex verifies that the original source of the review is Google. From the start, Expat Service have been responsive, professional, and amazing to work with. They handled everything greatly and made the process feel smooth and simple. Mr Roy van der Wiel, in particular, was very approachable and friendly, which really made a difference—you don’t often get that kind of personal touch with tax services. I would highly recommend them for filing your tax returns.Posted onTrustindex verifies that the original source of the review is Google. Expat services team is very professional and helpful. They replied quickly and took care of everything in a friendly and helpful manner. I would highly recommend themPosted onTrustindex verifies that the original source of the review is Google. I’ve worked with a few tax services in the past, but none have been as efficient and easy to work with as Expat Service B.V. Steve was really helpful during our advisory meeting and helped me understand how things work here in the Netherlands. Everything was done efficiently and correctly.Posted onTrustindex verifies that the original source of the review is Google. My 2024 Dutch return was the first time I needed professional help, and I’m so glad I went with Expat Service B.V. The staff gave really helpful guidance in our meeting, especially around the 30% ruling. The process was straightforward, and they were always available when I had questions. Definitely using them again next year.Posted onTrustindex verifies that the original source of the review is Google. Excellent services, quick, painless process and good follow up when needed.Posted on

Read the many reviews from expats who have gone before you and benefited from our unique service.

Through the questionnaire, we automatically recognize which forms need to be submitted. So you do not have to make a final selection below!

Income tax return with 30%- ruling

€ 190

Income tax return without 30%- ruling

€ 230

Income tax return with 30%-ruling and US nationality or green card holder

€ 325

Provisional tax return 2026

€ 75

Income tax return with 30%- ruling

€ 225

Income tax return without 30%- ruling

€ 265

Income tax return with 30%-ruling and US nationality or green card holder

€ 325

Income tax return 100% in the Netherlands for Dutch employer

€ 230

Income tax return 100% not the Netherlands for Dutch employer

€ 325

Calculation qualifying tax non resident

€ 190

Income tax return with 30%- ruling

€ 285

Income tax return without 30%- ruling

€ 345

Income tax return with 30%-ruling and US nationality or green card holder

€ 487.5

Provisional tax return 2026

€ 120

Income tax return with 30%- ruling

€ 337.5

Income tax return without 30%- ruling

€ 397.5

Income tax return with 30%-ruling and US nationality or green card holder

€ 487.5

Income tax return 100% in the Netherlands for Dutch employer

€ 345

Income tax return 100% not the Netherlands for Dutch employer

€ 487.5

Calculation qualifying tax non resident

€ 285

Income tax return (partner employed)

€ 675 ex vat

Income tax return (partner self-employed)

€ 750 ex vat

If your assets in box 3 exceed the tax free threshold of €57,684, or €115,368 (2025) with a fiscal partner, we charge an additional €250. Do you want to know more about the changes in box 3? Read our blog: Box 3 in transition fictitious or actual profit.

Income tax return with 30%- ruling

€ 190

Income tax return without 30%- ruling

€ 230

Income tax return with 30%-ruling and US nationality or green card holder

€ 325

Provisional tax return 2024

€ 75

Income tax return with 30%- ruling

€ 265

Income tax return without 30%- ruling

€ 225

Income tax return with 30%-ruling and US nationality or green card holder

€ 325

Income tax return 100% in the Netherlands for Dutch employer

€ 230

Income tax return 100% not the Netherlands for Dutch employer

€ 325

Calculation qualifying tax non resident

€ 190

Income tax return with 30%- ruling

€ 180

Income tax return without 30%- ruling

€ 210

Income tax return with 30%-ruling and US nationality or green card holder

€ 240

Income tax return with 30%- ruling

€ 2251

Income tax return without 30%- ruling

€ 285

Income tax return with 30%-ruling and US nationality or green card holder

€ 360

Provisional tax return 2024

€ 120

Income tax return with 30%- ruling

€ 270

Income tax return without 30%- ruling

€ 338

Income tax return with 30%-ruling and US nationality or green card holder

€ 360

Income tax return 100% in the Netherlands for Dutch employer

€ 315

Income tax return 100% not the Netherlands for Dutch employer

€ 360

Calculation qualifying tax non resident

€ 220

Income tax return with 30%- ruling

€ 180

Income tax return without 30%- ruling

€ 210

Income tax return with 30%-ruling and US nationality or green card holder

€ 240

Self employed Expats Dutch income tax return? Please contact our friendly customer service for a quotation.

Through the questionnaire, we automatically recognize which forms need to be submitted. So you do not have to make a final selection above!

In any event, send your return by May 1 following the tax year.

For example, the 2022 tax return must be received by the Tax Office by May 1, 2023. Avoid a tax penalty and make sure you are 100% tax compliant.

Need help or have any questions?

Contact our consultant Roy

Roy is consultant within Expat Service and helps answer any questions related to using the application.

Get 100% tax compliant

With our unique portal, you can easily prepare your own income tax returns.

All this in only 3 easy steps.

Expat Service helps expats with an online tax filing service for their income tax return. Efficient, simple and affordable tax filing whenever and wherever you are in the world. That’s why Expat Service is the intelligent choice for every expat.

HQ Netherlands, Stratumsedijk 6 Eindhoven I KvK/CoC 80399673

Expat Service © 2026 All rights reserved.